XRP Price Prediction: Technical Consolidation Meets Institutional Optimism

#XRP

- XRP trades below key moving averages but shows potential support near Bollinger Band lower boundary

- $500 million institutional investment and accelerated ETF plans provide strong fundamental backing

- Technical consolidation pattern suggests waiting for clear breakout above $2.45 resistance for bullish confirmation

XRP Price Prediction

XRP Technical Analysis Shows Consolidation Pattern

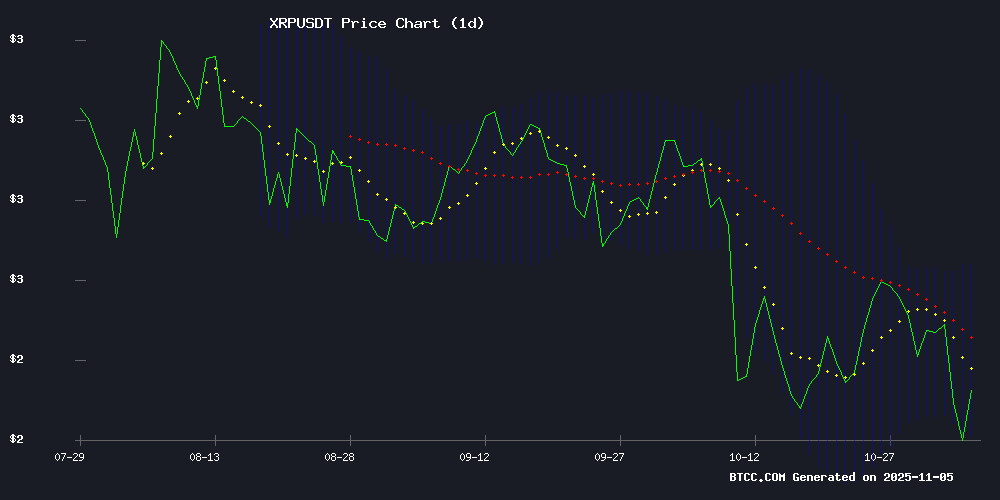

XRP is currently trading at $2.272, below its 20-day moving average of $2.4514, indicating short-term bearish pressure. The MACD reading of -0.0364 suggests weakening momentum, though the histogram shows some stabilization. Bollinger Bands position the current price NEAR the lower band at $2.2049, with the middle band at $2.4514 and upper band at $2.6980, creating a potential support zone.

According to BTCC financial analyst Ava, 'The technical setup suggests XRP is in a consolidation phase. The proximity to the lower Bollinger Band often precedes potential rebounds, but traders should watch for sustained breaks above the 20-day MA for confirmation of bullish momentum.'

Mixed Sentiment Surrounds XRP Amid Institutional Developments

Ripple's recent $500 million strategic investment led by Fortress and Citadel Securities at a $40 billion valuation demonstrates strong institutional confidence. Meanwhile, Franklin Templeton's accelerated XRP ETF launch plans signal growing mainstream adoption. However, XRP's struggle to break above $3 has prompted some investor rotation into emerging altcoins.

BTCC financial analyst Ava notes, 'The institutional developments are fundamentally positive, but the technical resistance at $3 remains a key psychological barrier. The ETF acceleration could provide the catalyst needed for a breakout, though timing remains uncertain.'

Factors Influencing XRP's Price

Ripple Secures $500M Strategic Investment at $40B Valuation Led by Fortress, Citadel Securities

Ripple has closed a $500 million strategic funding round at a $40 billion valuation, with Fortress Investment Group and Citadel Securities leading the investment. The round saw participation from prominent crypto-focused firms including Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace.

The deal reinforces Ripple's position as a dominant player in blockchain-based payments, with the company reporting $95 billion in total payment volume and a $1 billion market cap for its RLUSD stablecoin. This marks Ripple's strongest year to date, building on a $1 billion tender offer completed earlier in 2025 at the same valuation.

Institutional confidence continues to grow, with Ripple having repurchased over 25% of its outstanding shares in recent years. The involvement of traditional finance heavyweights signals Ripple's strategic push to deepen institutional partnerships as it expands its global footprint.

Franklin Templeton Accelerates XRP ETF Launch Plans Amid Industry Momentum

Franklin Templeton has filed an updated S-1 registration for its spot XRP ETF, marking the third issuer this week to modify critical effectiveness language. The amended filing—flagged by Bloomberg's James Seyffart—suggests a potential launch this month, reflecting heightened competition among asset managers to bring the first XRP ETF to market.

The MOVE follows Bitwise's fourth S-1 amendment on October 31, which included operational details like listing venues and fees. Meanwhile, Canary Funds triggered a 20-day countdown by removing standard delaying amendments, potentially enabling a November 13 launch pending Nasdaq approval. These technical adjustments signal advanced-stage preparations across multiple applicants.

XRP's Struggle Below $3 Drives Investors to Emerging Altcoins

Ripple's XRP continues to face resistance at the $3 level, frustrating investors anticipating a return to previous highs. The token's consolidation below this critical threshold has prompted traders to seek alternatives with clearer growth trajectories and higher profit potential.

Mutuum Finance emerges as a standout contender, priced at $0.035 during its Phase 6 presale—already 85% sold out. Its dual-lending protocol combining Peer-to-Peer and Peer-to-Contract agreements offers unique DeFi functionality, positioning it as a prime candidate for substantial gains in 2025's market cycle.

XRP shows technical vulnerability as it struggles to hold key support at $2.19. A breach could see prices slide toward $1.90, despite ongoing HYPE surrounding Ripple Swell. Whale activity appears poised to determine the token's next significant move.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a mixed investment case. The technical indicators show consolidation with potential for upward movement if key resistance levels are breached. Fundamentally, the institutional developments are strongly positive.

| Metric | Current Value | Interpretation |

|---|---|---|

| Current Price | $2.272 | Below 20-day MA |

| 20-day MA | $2.4514 | Resistance level |

| MACD | -0.0364 | Bearish momentum |

| Bollinger Lower Band | $2.2049 | Potential support |

| Institutional Investment | $500M | Strong bullish signal |

| ETF Progress | Accelerated | Positive catalyst |

According to BTCC financial analyst Ava, 'While short-term technicals suggest caution, the strong institutional backing and ETF developments provide compelling long-term fundamentals. Investors should consider dollar-cost averaging and watch for breaks above $2.45 for confirmation of bullish momentum.'